new mexico gross receipts tax rate

Indiana will begin levying a 15 percent wholesale tax on vapor products. Effective July 1 2021 most businesses will collect the Gross Receipts Tax based on the rate where their goods or products of their services are delivered.

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

On April 4 2019 New Mexico Gov.

. This would be the first change in the statewide gross receipts tax rate since July of 2010 when the rate increased from 5 percent to its current 5125 percent. Illinois will begin a year-long sales tax holiday on groceries. Gross receipts tax or compensating tax collected by dealer registered with the.

NMHBA EVPCEO Jack Milarch explains the ins and outs of figuring out what the new Regulations need to consider for implementation of the new law. Pawn Second Hand Precious Metal Dealers Permits. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 8938 across the state with an average local tax of 226 for a total of 726 when combined with the state sales tax.

There is a variance because the. New Mexico first adopted a version called a gross receipts tax in 1933 and since that time the rate has risen to 5125 percent. This means there will no longer be a difference in rates between the two taxes.

The maximum local tax rate allowed by New. Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the proper amount of Gross Receipts Tax is computed and collected by the title company. New Mexico Gross Receipts Quick Find is available.

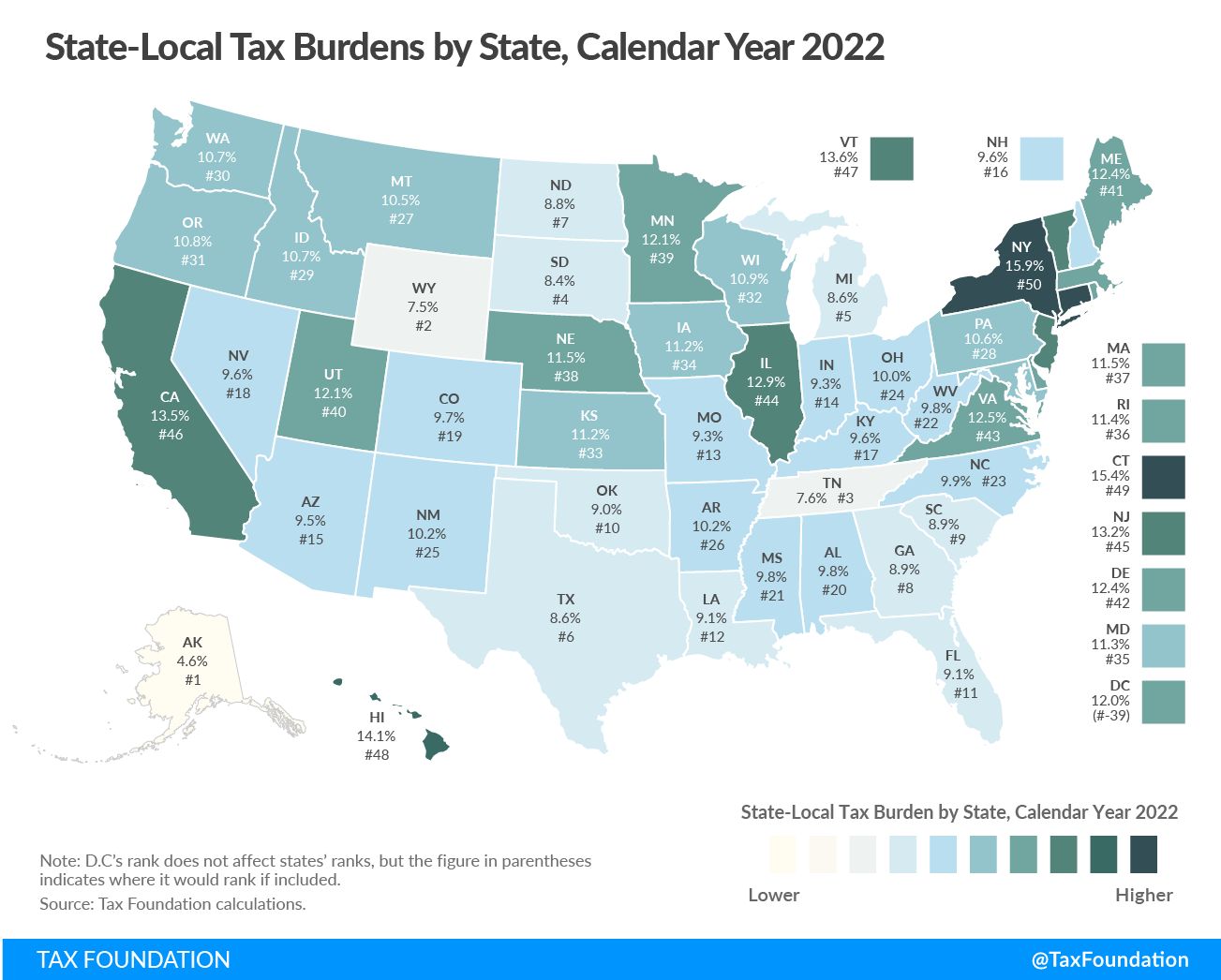

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Pay Parking Citations Excavation Barricade Permits Health Permit Renewal Alarm Fees.

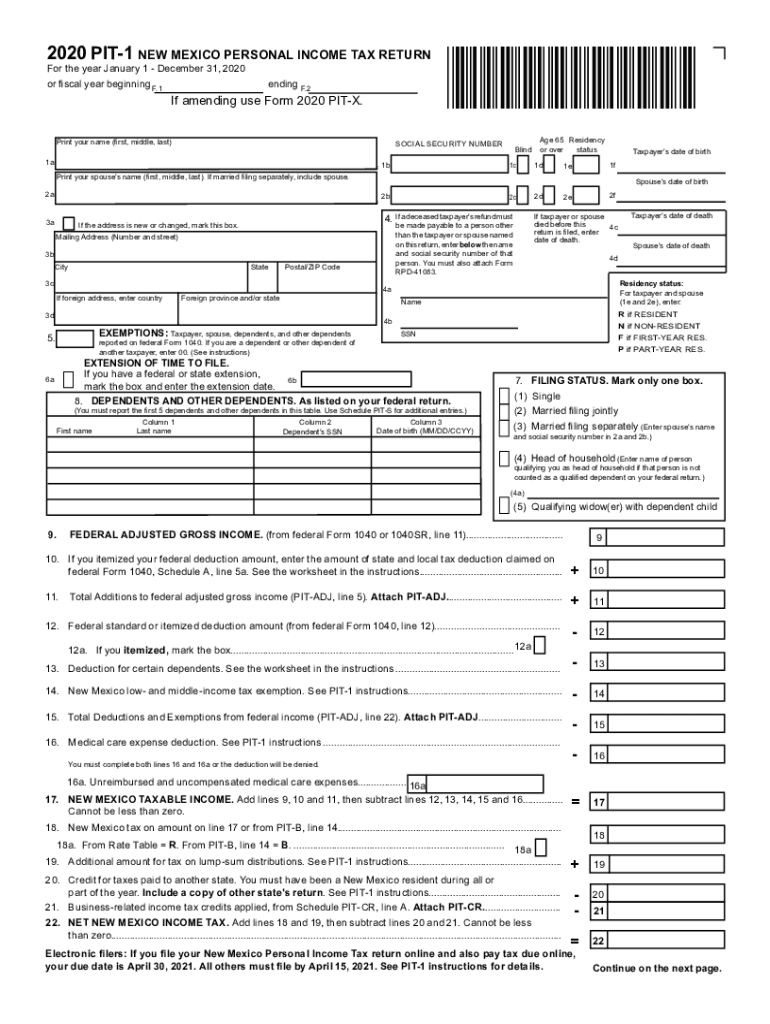

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. The changes to the GRT came primarily in response to the US. New Mexico Gross Receipts Tax August 2012 New GRT Rules.

The taxable value of property is 13 of the assessed value. Sales use excise manufacturers tax paid to another state attach proof of payment 5. Multiple line 1 by line 2.

Every person required to file a New Mexico gross receipts tax return must complete and file a TRD-41413 New Mexico Gross Receipts Tax Return. As of 7121 New Mexico is considered a destination-based sales tax state. Colorado instates a retail delivery fee which is really a tax.

Counties and cities can charge an additional local sales tax of up to 3563 for a maximum possible combined sales tax of 8693. New Mexicos gross. Anyone who operates a business in New Mexico is familiar with the gross receipts tax or GRT a tax not on sales but on companies and people who do business here.

Compensating tax rate of the reporting location same as gross receipts tax rate of the location 3. The rate of New Mexicos hybrid sales taxwhich the state calls a gross receipts taxwill decline from 5125 to 50 percent. There are a few ways to determine the proper location code.

The Gross Receipts Tax rate varies throughout the state from 5125 percent to 94375 percent. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. This is a significant expansion of the.

Groceries are exempt from the New Mexico sales tax. Normally the business passes the tax on to the purchaser. Use a Tax Rate Table.

Anything over 5125 percent represents local option rates imposed by. The base rate of the gross receipts tax in New Mexico is 5125. The statewide gross receipts tax rate is 5125 while city and county taxes can add up to a total of 4125.

Compensating tax is an excise tax imposed on persons using property or services in New Mexico also called use tax or buyer pays. How to use the map. The table below shows state county and city rates in every county in New Mexico as well as some of the largest cities.

Use the Schedule A New. In addition compensating tax is now imposed on the privilege of using services in New Mexico. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest.

New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or services. Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. The TaxJar API has been updated to reflect destination-based sourcing effective July 1 2021.

Submit Current Contact Information. A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. Remote sellers will now pay both the statewide rate and local-option Gross Receipts Taxes.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. Just like sales taxes in other states local jurisdictions can put additional taxes in place in their area and that means that the effective rate across the state can vary quite a bit. The business pays the total Gross Receipts Tax to the state which then distributes the counties and.

The highest gross receipts tax rate in New Mexico is 88675 and there are a range of values. The gross receipts tax rate for purchases made in the metro area ranges from 6375 to 83125 percent throughout the MSA. Liquor Pawnbroker License Holders.

This resembles a sales tax but unlike the sales taxes in many states it applies to services as well as tangible goods. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent. The New Mexico gross receipts tax rate is 5125.

New Mexico Gross Receipts Tax. Supreme Court decision in South Dakota v. By Finance New Mexico.

The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

The Gross Receipts tax rate now is calculated based on where the goods or products of services are delivered. A tax rate of about 30 mills is applied to the. The Gross Receipts map below will operate directly from this web page but may also be launched from the Departments Web Map Portal portal link located below the map.

New Mexico has 419 special sales tax jurisdictions with. New Mexico imposes a gross receipts tax on businesses. Albuquerques Gross Receipts Tax rate is 7875 percent.

Lowest sales tax 55 Highest. 352 rows 2022 List of New Mexico Local Sales Tax Rates. Gross Receipts Tax Rate Schedule.

Companies with no physical location or resident salesperson pay tax at the rate for out-of-state businesses. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Most states have a Sales and Use Tax that is applied to the sale of physical products such as electronics cars books furniture appliances raw materials etc or certain services.

New Mexico Gross Receipts Tax April 2012 Contractors and Gross Receipts Tax The Basics and The Changes. On top of the state gross receipts tax there may be one or more local taxes as well as one or more special.

New Mexico Grt Rate Maps Taos County Association Of Realtors

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Complete Guide To New Mexico Payroll Taxes

New Mexico Tax Law Unintentionally Cuts Into City Revenues Kob Com

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

New Mexico Grt Rate Maps Taos County Association Of Realtors

As Sales Tax Drops In Nm Hard Choices Await Albuquerque Journal

Gross Receipts Location Code And Tax Rate Map Governments

Gross Receipts Location Code And Tax Rate Map Governments

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Nm Trd Pit 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

New Mexico Lawmakers Ok Crime Bill 500m In Tax Rebates

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal